ISLAMABAD, Pakistan, March 04, 2026 (GLOBE NEWSWIRE) — On February 18, 2026, GOLD BOX Pakistan, a leading mystery box e-commerce platform in Pakistan, announced the completion of a new round of financing worth $65 million. The round was led by Tophatter, a U.S.-based innovation and incubation firm, with participation from multiple industrial capitals and strategic investment institutions. This marks GOLD BOX Pakistan’s second major capital injection in just over a year, following Tophatter’s initial $12 million investment in 2025. The total funding raised has now reached $77 million, demonstrating strong recognition from global capital markets of its business...

- How the war in Iran and trader positioning could be behind the surge in Circle's stockCoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 34 minutes ago

- Crypto and stocks add to gains as Trump says Iran war could be over soonCoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 1 hour ago

- Bitcoin could be the big winner if the U.S.-Iran conflict drags on for monthsCoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 5 hours ago

- Bitcoin rises to $69,000, stocks reverse big early losses, as crude oil sinks back below $100CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 5 hours ago

- Josh Swihart's Zcash Open Development Lab raises $25 million in seed fundingCoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 5 hours ago

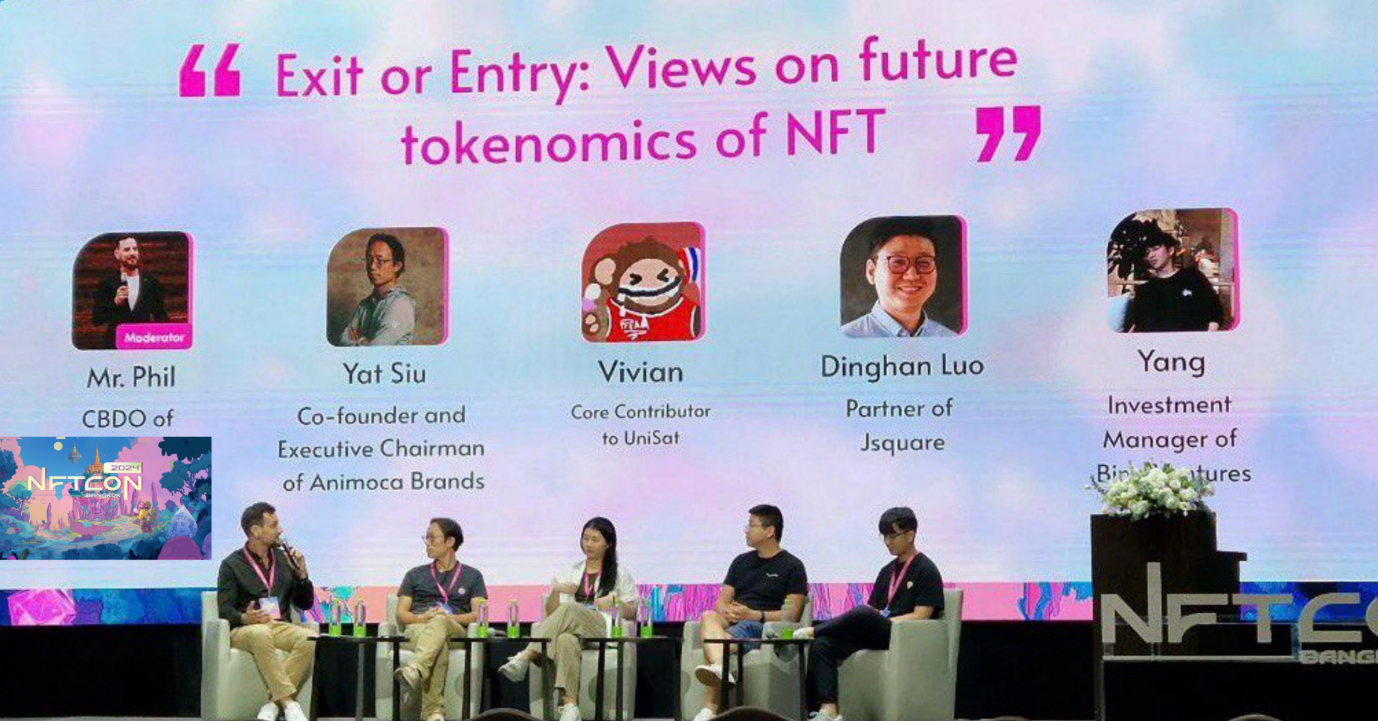

Universe Pro 2026: Mr. Phil Leads the Shift Toward Capital-Efficient Onchain Infrastructure

March 4, 2026 / Universe Pro, a next-generation onchain trading infrastructure company, highlights the professional background of its Chief Executive Officer, Mr. Phil, whose decade-long leadership in Web3 business development and ecosystem acceleration has helped shape some of the industry’s most influential ventures. About Mr. Phil Born in Eastern Europe and fluent in English and German, Mr. Phil brings a strategic combination of technical depth and business acumen to the forefront of Web3 innovation. Prior to founding Universe Pro, he spent over a decade as a Blockchain Business Developer (BBD), where his contributions focused on high-performance Web3 project acceleration, ecosystem development, and capital-efficient...

World Heavyweight Champion Oleksandr Usyk to become a Shareholder of Estonian Fintech Kauri Finance

Kauri Finance, an Estonian-based financial service provider, has officially finalized an agreement in Tallinn to welcome undisputed World Heavyweight Champion Oleksandr Usyk as a strategic stakeholder (after receipt of relevant regulatory approvals). This partnership combines Kauri Finance’s eight years of regulated fintech expertise with Oleksandr Usyk’s long-term strategic involvement as an investor and co-founder. The partnership is focused on the next evolutionary step for Kauri Finance: becoming a fully licensed EMI and CASP. Upon receipt of the EMI and CASP licenses and the achievement of Visa and Mastercard Principal Memberships, Kauri Finance will provide high-quality, secure, and modern financial services...

OCM Showcases “OCM Snack Feast” at Brooklyn Nets Chinese New Year Celebration

OCM proudly participated in the Brooklyn Nets Chinese New Year Theme Night at Barclays Center, successfully hosting the “OCM Snack Feast” activation that introduced thousands of attendees to a curated selection of Asian snacks and festive experiences. Fans and attendees enjoyed a curated selection of classic Asian New Year snacks, including candies, cookies, and popular packaged treats, offering an immersive cultural experience alongside the game. Many well-known Asian brands, together with Hsu Fu Chi — China’s No.1 candy brand — and AIKO GARDEN, the 3D fruit ice cream sensation that has taken the U.S. by storm, join everyone in celebrating...

Claude Riveloux Discusses Market Volatility and Shifting Trends in Technology Equities.

NEW YORK, USA – Recent fluctuations in U.S. equity markets, particularly within the technology sector, have drawn increased attention from investors and market observers. The Nasdaq has experienced notable monthly declines amid evolving sentiment surrounding artificial intelligence (AI) investment and broader macroeconomic conditions. Claude Riveloux, Chief Strategist, offers a measured perspective on these developments, highlighting the importance of disciplined portfolio management and long-term fundamentals during periods of heightened volatility. Market Context: AI Investment and Capital Allocation Trends Over the past several years, artificial intelligence has been a major driver of capital expenditure and investor enthusiasm within the technology sector. As companies...

- Aon tests stablecoin payments for insurance premiums with Paxos, CoinbaseCointelegraph.com News - 28 minutes agoThe insurance broker is piloting stablecoin payments for premiums using USDC and PYUSD, testing blockchain settlement rails for faster payments in global insurance markets.Aon, one…

- Wyoming Senator revives crypto tax exemption debate amid market structure talksCointelegraph.com News - 2 hours agoCynthia Lummis continues to push pro-crypto policies in a market structure bill under consideration in the Senate, even as she prepares to leave Congress in…

- Price predictions 3/9: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCHCointelegraph.com News - 3 hours agoBuyers were undeterred by surging oil prices, pushing Bitcoin near $69,500 and large-cap altcoins close to their overhead resistance levels.Key points:Rising oil prices have not…

- Blockchain.com expands into Ghana after 700% trading growth in NigeriaCointelegraph.com News - 3 hours agoThe crypto brokerage said increasing demand across West Africa is driving its expansion as user activity grows across the Sub-Saharan region.Crypto brokerage company Blockchain.com is expanding into Ghana as…

- Can you still mine Bitcoin on a PC in 2026? Here is the realityCointelegraph.com News - 4 hours agoMining Bitcoin on a desktop in 2026 may sound simple, but is it profitable? Do rising network difficulty and energy costs mean the end of…

Live Analysis

| # | Coin | Price | Marketcap | Volume (24h) | Supply | Change | Last 24h | Symbol | Price (BTC) |

|---|